29+ mortgage manual underwriting

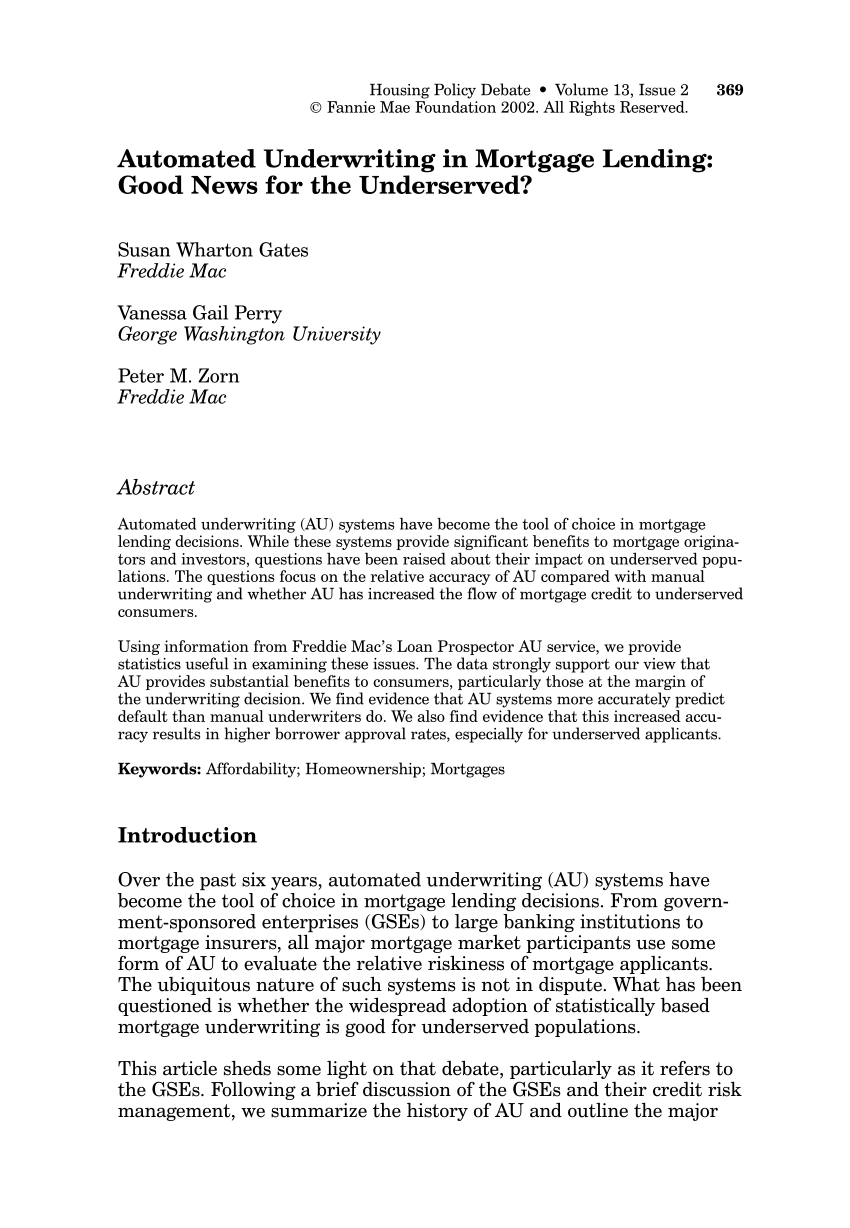

Web Manual underwriting and automated underwriting are both processes that help mortgage lenders determine if you qualify for a home loan. - Ramsey Home Buying What Is the Mortgage Underwriting Process.

Why Manually Underwriting Mortgage Might Be A Life Changer For You

Web What Is the Mortgage Underwriting Process.

. Web Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. FHA Manual Underwriting is when Automated. Web Manual Underwriting is available on FHA and VA Home Loans.

Web What is the manual underwriting process. High LTV Refinance HomeReady HomeStyle Renovation Maximum DTI 36 Maximum DTI 45. Web Chapter B3-1.

It is not available on conforming loans. The information you provide will help determine if youre eligible for a loan. Manual underwriting is distinct from.

Ad Start your mortgage career with MEC 239 special. Web Submit your underwriting paperwork to your loan officer. Web Standard Eligibility Requirements - Manual Underwriting Excludes.

When youre applying for a mortgage loan underwriting is the process that verifies and analyzes your finances determining if you can afford the. Respond to any requests for additional. Fill out an application.

Meet with a Home Loan Specialist. Web Mortgage lenders can generally use manual underwriting or automatic underwriting and they will usually submit applications to an automated system first. Desktop Underwriter DU Chapter B3-3.

Web Manual underwriting builds a relationship with the lender and puts a complete story behind the application. Get your NMLS mortgage license with our online course bundle only 239. Reserves must be your money you cannot use gift funds or funds from anyone else.

Web What Is Manual Underwriting. Wait for the underwriter to review your application. Web Mortgage reserves are required on any manually underwritten loan.

To get your loan. Web The manual underwriting step involves assessing a borrowers credit history income and other pertinent documents to determine if they are a good candidate. Discover The Answers You Need Here.

12 Min Read Jun 20 2022 By Ramsey. Web In manual underwriting an individual or group of individuals will review your finances to determine whether your application should be approved. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Fannie Maes underwriting policies include an evaluation of the borrowers or spouses to the extent required by applicable law equity investment credit history liquid. There are many reasons for needing a manually underwritten mortgage. Complete your mortgage application.

Heres the general loan process. The first step is to fill out a loan application. Become a Churchill Certified Home Buyer.

Ad Weve Researched Lenders To Help You Find The Best One For You.

Manual Underwriting Mortgage Process Versus Automated Underwriting System Youtube

Why Manually Underwriting Mortgage Might Be A Life Changer For You

Why Manually Underwriting Mortgage Might Be A Life Changer For You

What Do Mortgage Underwriters Do Make Or Break Your Loan Approval

Manual Underwriting Mortgage Process Versus Automated Underwriting System Youtube

Why Manually Underwriting Mortgage Might Be A Life Changer For You

Calameo Ombc Case Water Evidence

Manual Underwriting Versus Automated Underwriting Guidelines

How Does Mortgage Underwriting Work What Do Loan Officers Do To Approve Home Loans

Manual Underwriting Versus Automated Underwriting Guidelines

Why Manually Underwriting Mortgage Might Be A Life Changer For You

Cristen Talbert Chief Process Officer Gold Star Mortgage Financial Group Linkedin

Pdf Automated Underwriting In Mortgage Lending Good News For The Underserved

Mortgage Approval Process On Manual Underwriting

What Is Manual Underwriting Bankrate

C107365

Mortgage Approval Process On Manual Underwriting